- The Compound Insider

- Posts

- Never Hire an Optimistic Credit Manager

Never Hire an Optimistic Credit Manager

This Week on The Compound

Advertisement

This week on TCAF, Josh and Michael were joined by Sonali Basak, Chief Investment Strategist at iCapital, and Ben Carlson of Ritholtz Wealth Management. They discussed the state of Las Vegas, the private credit landscape, stress in BDCs, and the importance of manager skill in private assets. (Listen)

Value+Momentum: The Best of Both Factors | Talk Your Book (Listen)

The Stock Market Booms While No One Can Get a Job | What Are Your Thoughts? (Listen)

A Year-End Rally Could Double the S&P 500’s Gain This Year | Live From the Compound (Listen)

What is the Dave Ramsey Portfolio? | Ask the Compound (Listen)

It’s Only a Bubble If You Panic | The Compound and Friends (Listen)

INSIDE THE COMPOUND

AI bubble talk is rampant these days. Barry Ritholtz at The Big Picture notes that not every market boom is a bubble. Ritholtz examines the history of large market bubbles and their common characteristics. He writes:

Excess enthusiasm in asset prices spans a wide range: there is overly bullish sentiment, mispricing, overvaluation, speculative excess, booms, manias, and frenzies. And then there are Bubbles.

People throw that word around far too easily; a bubble is a relatively rare event, and not something that occurs annually. We see bubbles only once every few decades.

OUTSIDE THE COMPOUND

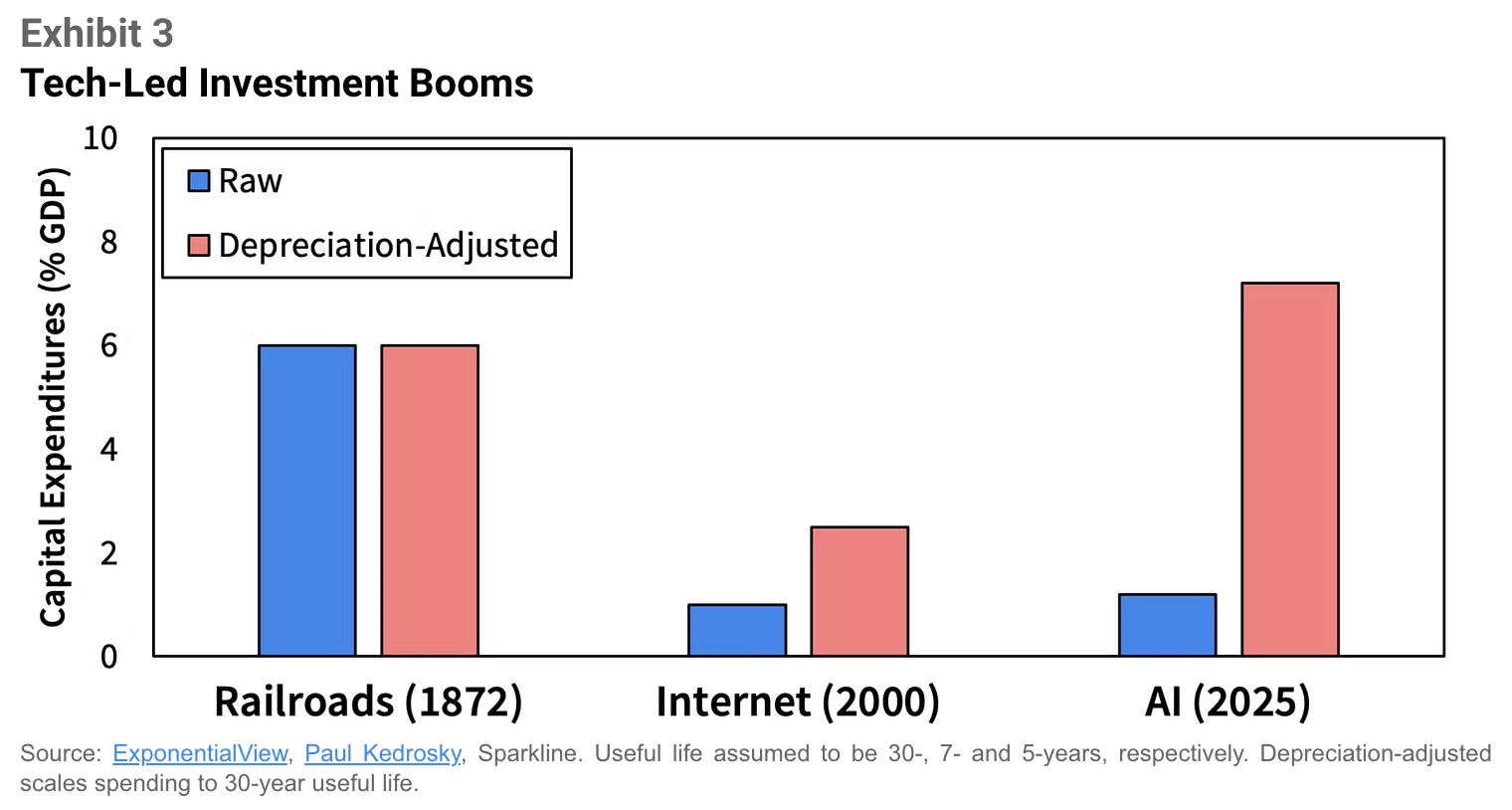

Prior TCAF guest, Kai Wu of Sparkline Capital, published a notable report this week on the AI capex boom. He examines some of the obvious and not-so-obvious winners, noting the greater risk the leading AI players are taking by now spending so much on everything compute-related. He writes:

Historically, massive infrastructure spending, especially that without a clear path to revenue, has led to excess capacity and poor returns. We find this capital cycle operates not only at the macro level with the railroad and Internet buildouts, but also at the individual firm level – firms aggressively increasing capital expenditures tend to subsequently underperform both the market and their sector peers.

MERCH

The Animal Spirits Fall Mug is here! Ben may not drink coffee, but you can out of these new mugs. Remember, you can always check out all our cool merch at idontshop.com.

COMING SOON

This week on TCAF, Josh and Michael will be joined by Stephanie Roth, Chief Economist at Wolfe Research.

FEEDBACK

Got something to say? Reach out to the shows at Animal Spirits or Ask the Compound.

Interested in sponsoring The Compound? Reach out to Graham for details.